Early Post-Election Takeaways: Comparing 2024 to 2016

The election is over, and global markets are analyzing the outcome and starting to adjust portfolios. Republicans are set to control the White House, Senate, and House, but the results are also notable for a historical reason: the president-elect, Donald Trump, is returning to office after a previous election loss—a rare political comeback not seen since Grover Cleveland in 1892. As a result, investors are looking to Trump’s first term as a roadmap for how this administration’s policies may impact markets.

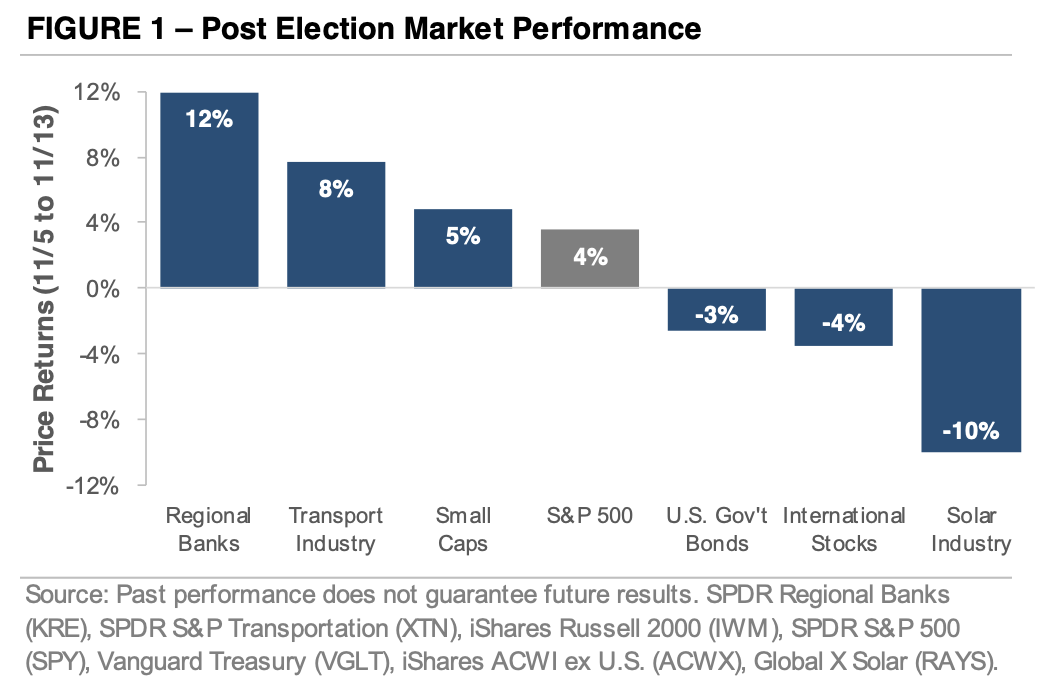

The early returns in Figure 1 show that investors expect a repeat of Trump’s first term. Bank stocks are rising due to expected deregulation, and small-cap stocks are trading higher in anticipation of tax cuts, deregulation, and protectionist trade policies that may favor domestically focused companies. In contrast, international stocks have declined due to concerns about the impact of tariffs on global trade. Renewable energy stocks have declined as well, with investors expecting Trump to roll back clean energy policies and subsidies. In the bond market, Treasury yields have risen due to concerns that tax cuts will keep the federal deficit high. These early trends reflect a mix of the prior administration’s policies and recent campaign messaging.

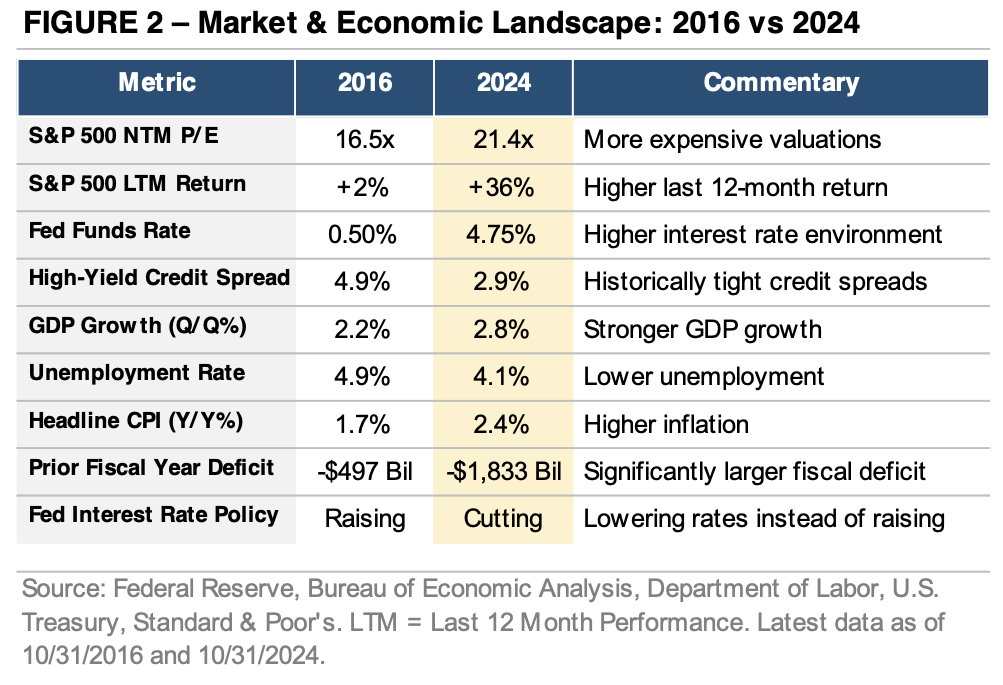

The market’s initial reaction, modeled after the first Trump administration, is understandable. However, Figure 2 shows the economic and financial landscape has changed since then. In 2016, the U.S. economy was emerging from the 2015 industrial slowdown with sluggish manufacturing and weak growth. Today, the economy is quite different: growth is stronger, unemployment is lower, consumer spending is robust, and the federal deficit is bigger. Additionally, the Federal Reserve is cutting interest rates rather than raising them, and the pandemic has reshaped the global economy. In the equity market, the S&P 500 returned +36% in the 12 months before this election, compared to only +2% before 2016. Stock market valuations are more expensive, interest rates are higher, and credit spreads are tighter.

The market appears to be in “copy-paste” mode, using Trump’s first term to guide investment decisions. However, investing is rarely that straightforward. The second Trump administration will impact markets, but fundamentals and economic data will continue to be the primary drivers. The key point: Trump 2.0 doesn’t necessarily imply Markets 2.0. The president is the same, but the economy and markets are different.